January 1, 2013 / Arnoldas Tomasevicius

Objects of the Mortgage Register

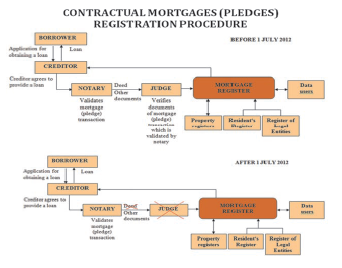

- contractual mortgages (pledges) Contractual mortgages (pledges) are agreements of the contractors to mortgage (pledge) immovable or movable property or property rights or unilateral application of the owner of the immovable/movable property or property rights to mortgage (pledge) it

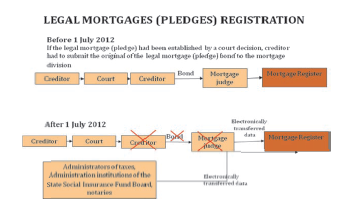

- legal mortgages (pledges) Legal mortgages (pledges) are mortgages (pledges) of immovable property as well as movable property or property rights without a will of the owner

- mortgage (pledge) transactions

Data about these objects are stored and processed in the Mortgage Register as well as data about the marks of notary enforceable records.

New mortgage registration system

The Mortgage Register of the Republic of Lithuania started its activity on 1 April 1998. It is managed by Central Mortgage Office and it is one of 6 main state registers.

In 2012 Lithuania basically reformed the Mortgage register. The Mortgage register is maintained only on the basis of the documents received in electronic form. Mortgage registration procedure has become simpler and faster, «one-stop shop” was implemented in the mortgage registration process, administrative burden for citizens and businesses was reduced in the mortgage registration process.

On the 1st of July 2012 Central Mortgage Office has introduced a new model of mortgage and pledge registration: refused excess functions of a mortgage judge in mortgage (pledge) registration process, also, refused mortgage divisions upon district courts. People applying for a loan now can deal with mortgage related affairs in a “one-stop shop” way, when data is electronically transferred to the Mortgage Register. Mortgage (pledge) registration process is now simpler: a notary who validates mortgage (pledge) transaction can directly transfer data to the Mortgage Register using the Mortgage and pledge making and registration electronic program. After the reform a possibility to pledge enterprise as a property complex is established.

Before the reform the mortgage transaction had standardized form, which was set by the Minister of Justice. From now on parties can decide which terms are the most important and should be included into the mortgage (pledge) transaction. Contractual mortgage (pledge) now comes into force after it is signed by the parties of transaction and approved by notary (if there are no other conditions), but not after their registration in the Mortgage Register, like it was before. The purpose of such registration is just to publish legal rights and obligations. The registration of contractual mortgages is not obligatory anymore, but as far as we know, all mortgage transactions are registered in the Mortgage Register.

Essential change in the reform is that mortgage and pledge registration has been made administrative, not judicial process

Before the reform a person wishing to set up a mortgage transaction had to go to the notary, but mortgage or pledge transaction was recorded in the register after mortgage judge proceedings. Mortgage and pledge registration process has become much faster after refusal of mortgage judge. Now mortgage transaction approved by notary is recorded in the Mortgage register on the same day or no later than the next business day. Previously it was necessary to apply mortgage documents and their copies to a one of 15 mortgage judges depending where the mortgaged real property is situated. Parties often had to travel to another city or had to send mortgage documents by mail. Mortgage registration process from the applying the mortgage judge took up to three business days.

Data to the Mortgage register now are transferred electronically. The access (user names and passwords) to data provision program is given after signing a Contract of Data Provision Electronically to the Mortgage Register of the Republic of Lithuania between the Central Mortgage Office and data providers.

Register data providers

- notary who validates mortgage (pledge) transactions, their changes and extinction, who makes or cancels an enforceable record, who establishes legal mortgages (pledges), their changes and endings, as well as who gets a request from the creditor to transfer data of the legal mortgage (pledge) or other request concerned with data transfer to the Mortgage Register;

- court who makes a decision about mortgage (pledge) transactions, their changes and extinction, who establishes legal mortgages (pledges), their changes and endings;

- officer or institution empowered by law (administrators of taxes, administration institutions of the State Social Insurance Fund Board, Customs Department), who establishes legal mortgages (pledges), their changes and extinction;

- creditor, debtor, owner or a person having the object of pledge (only in certain cases, detailed in the Regulations of the Mortgage Register (when the owner of the mortgage (pledge) object changes, when there are changes of the name, surname or address as well as there is a change of the creditor or the fact of the appointed property administrator).

Data and documents

Data providers have a legal obligation to ensure that the data which they provide to the Mortgage Register would be accurate and correct.

- Notary who has validated mortgage (pledge) transaction within 1 business day has to provide a notification about validated mortgage (pledge) transaction with a digital text copy of the transaction signed by electronic signature.

If the object of contractual mortgage is enterprise the digital copy of the act of its inventory should be provided as well. - Notary, court, officer or institution empowered by law who has established legal mortgage (pledge) within 1 workday after the court decision has become final (if legal mortgage (pledge) has been established by court) or after the legal mortgage (pledge) has been established by notary, officer or institution empowered by law has to provide a notification about established legal mortgage (pledge) with a digital copy of the decision under which legal mortgage (pledge) has been established.

Registration of the Register objects

Parties of the mortgage (pledge) transaction have a possibility to decide whether this transaction should be registered in the Mortgage Register or not. Mortgage (pledge) shall be registered within one business day from the date of receipt of a notification about validated mortgage (pledge) transaction / established legal mortgage (pledge). After the mortgage (pledge) registration data of mortgaged (pledged) assets are sent electronically to the appropriate property register.

Mortgage register has interaction with related Registers:

- Residents’ Register of the Republic of Lithuania;

- Register of Legal Entities;

- Real Property Cadaster and Register;

- Register of Sea-Going Ships of the Republic of Lithuania;

- Registers of Inland Waterways Craft of the Republic of Lithuania;

- Register of Railway Rolling Stock and Containers;

- Register of Trademarks of the Republic of Lithuania;

- Register of Patents of the Republic of Lithuania;

- Register of Designs of the Republic of Lithuania;

- Register of Tractors, Self-Propelled and Agricultural Vehicles and their Trailers;

- the Civil Aircraft Register of the Republic of Lithuania;

- Register of Motor Vehicles of the Republic of Lithuania;

- Register of Armament;

- Address Register;

- Register of Foreigners.

The interaction with related registers is also used for the checking of the data of counterparties and mortgaged assets. Data are automatically checked in the related registers at the time of mortgage or pledge registration. This interaction helps to avoid mistakes during the registration process. Data provider is informed about data inaccuracies and shortcomings electronically within 3 business days from the receipt of the notification if data provided in notification is inaccurate, incomplete or incorrect and (or) not all necessary documents have been provided to the Mortgage Register. Time limit of 10 business days shall be given in order to eliminate data inaccuracies and shortcomings. If data provider does not eliminate shortcomings which have been noticed by the registrar in time the mortgage (pledge) is not registered. Other backgrounds of refusal to register the mortgage (pledge) are:

- There is no information that registration fee has been paid for the mortgage (pledge) registration, for its data change recording or for the mortgage (pledge) deregistration:

- for registration – 108 LTL (or 31 EUR)

- for data change recording – 31 LTL (or 9 EUR)

- for deregistration – 10 LTL (or 3 EUR)

- Data provider has provided a notifications and documents to register the mortgage (pledge) which has been already registered or to deregister the mortgage (pledge) which has been already deregistered.

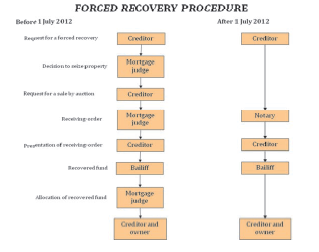

Forced recovery procedure

Forced recovery process has been made faster, simpler and more economical after mortgage judge was eliminated from this process. Forced recovery process now starts after the notary makes an enforceable record. Creditor has a possibility to ask the notary to make an enforceable record and such enforceable record is considered to be enforceable document which can be presented to a bailiff. The bailiff distributes recovered funds to the creditor and sold property owner himself, rather than mortgage judge as it was before.

5 main legal acts regulating the activity of the Mortgage Register:

Civil Code of the Republic of Lithuania

- Establishes the concept of the Mortgage Register objects

- Gives the definition of mortgage (pledge) and its types

- Establishes the main principles of mortgage (pledge) registration and forced recovery

- States legal consequences of mortgage registration

- Prescribes who can provide data to the Mortgage Register

Act of the Establishment of the Mortgage Register of the Republic of Lithuania

- Establishes Mortgage Register of the Republic of Lithuania objects, processing of data, financing of the Register, its reorganization and liquidation.

- States that Mortgage Register is the main state register.

- Establishes Register manager:

- Ministry of Justice of the Republic of Lithuania (Register manager);

- Central Mortgage Office (Register administrator).

Regulations of the Mortgage Register of the Republic of Lithuania

Establish:

- the purpose of the Mortgage Register of the Republic of Lithuania;

- its objects;

- rights of Register manager and administrator;

- processing of data and information of the Register, as well as processing documents and (or) their copies;

- interaction with other registers;

- protection of data and information of the Register;

- delivery and transmission of data to foreign states;

- financing of the Register, its reorganization and liquidation.

Instruction of the Mortgage Register of the Republic of Lithuania Objects Registration and Data Provision

Prescribes objects registration (deregistration), data amendments recording procedure as well as error correction procedure, conditions of data provision, responsibility of data providers and Register administrator, also responsibility of its officers and employees working under an employment contract.

Instruction of Data Provision Electronically to the Mortgage Register of the Republic of Lithuania (data provision program guide)

- Gives instruction to notaries how to prepare contractual mortgages (pledges) transactions, agreements to change mortgage (pledge) provisions or to end mortgage (pledge), how to prepare notary enforceable records as well as how to provide data and documents to the Register using program.

- Gives instruction to notaries, courts, officers and institutions empowered by law how to provide data and documents to the Register about established legal mortgages (pledges), their changes and extinction as well as data and documents about courts decisions concerned with mortgage (pledge) transactions, their changes and endings using program.

Central Mortgage Office of Lithuania manages 6 more registers:

Register of Wills

The register started its activity on 1 July 2001. Objects of the Register are wills and facts of acceptance of inheritance.

Data about the content of will and testator’s will are not stored and processed in the Register of Wills.

Register of Property Seizure Acts

The Register started its activity on 1 January 2002. Objects of the Register are property seizure acts of courts, bailiffs, prosecutors, State Tax Inspectorate under the Ministry of Finance of the Republic of Lithuania, State Social Insurance Fund Board under the Ministry of Social Security and Labour of the Republic of Lithuania and other institutions and officers by which rights to the property located in the Republic of Lithuania are temporarily restricted by force by seizing the property in accordance with the grounds and order established by laws.

Register of Marriage Settlements

The Register started its activity on 1 July 2002. Objects of the Register are: marriage settlements; cohabitation settlements on the division of jointly acquired and used property at the end of co-habitation; facts of the division of property (settlements and court decisions on division of joint property of spouses).

Register of Contracts

The Register started its activity on 17 July 2002. Objects of the Register: contracts of Instalment Sale; contracts of Sale with Right of Redemption; leasing (financial lease) agreements.

The object of such contracts is a thing which has not/can not be registered (in appropriate property register), acquired for the business or services.

Register of Legally Incapable Persons or Persons With Limited Legal Capacity

The Register started its activity on 1 January 2011. Objects of the Register are: persons acknowledged as legally incapable by court judgement; persons whose legal capacity was limited by court judgement; minors from fourteen to eighteen-year-old whose rights to independently use their income and property were restricted or withdrawn by court judgement.

Register of Powers of Attorney Verified by a Notary

The Register started its activity on 1 January 2011. Objects of the Register are: 1. the powers of attorney certified by a notary or a consular officer: a) to conclude contracts whereby a notarial form is obligatory; b) to perform, in natural person’s name, the actions related to legal persons, with the exception of the cases where the authorisation of a different form is permitted; c) to administer, use or dispose of his immovable property granted by a natural person; d) other powers of attorney certified by a notary; 2. the powers of attorney certified by the authority equal to a notary: a) powers of attorney of servicemen verified by the commanders (heads)of military units, formations, military institutions and military schools; b) powers of attorney of people in imprisonment institutions verified by the heads of imprisonment institutions; c) powers of attorney of long voyage seamen on the ships, navigating under the colours of Lithuania, verified by the captains of the said ships.