January 1, 2015 / ELRA Secretariat

Central Mortgage Office of Lithuania

Objects of the Mortgage Register of the Republic of Lithuania:

- contractual mortgages and pledges Contractual mortgages (pledges) are agreements of the contractors to mortgage (pledge) immovable or movable property or property rights or unilateral application of the owner of the immovable/movable property or property rights to mortgage (pledge) it

- legal mortgages (pledges) Legal mortgages (pledges) are mortgages (pledges) of immovable property as well as movable property or property rights without a will of the owner

- mortgage (pledge) transactions

Data about these objects are stored and processed in the Mortgage Register as well as data about the Entries about the execution of the notarial enforcement order. Register started its activity on 1 April 1998 and it is managed by Central Mortgage Office.

On the 1st of July 2012 Lithuania basically reformed the Mortgage register. The Mortgage register is maintained only on the basis of the documents received in electronic form. Mortgage and pledge registration procedure has become simpler and faster, «one-stop shop” was implemented in the mortgage registration process, administrative burden for citizens and businesses was reduced in the mortgage registration process.

Essential change in the reform is that mortgage and pledge registration has been made administrative, not judicial process. Before the reform a person wishing to set up a mortgage transaction had to refer to the notary, but mortgage or pledge transaction was recorded in the register and came into force after mortgage judge proceedings. Excess functions of the mortgage judge in mortgage (pledge) registration process were refused. Mortgage (pledge) registration process is simpler now: a notary who validates mortgage (pledge) transaction can directly transfer data to the Mortgage Register using the Mortgage and pledge making and registration electronic program. This means that people applying for a loan can deal with mortgage related affairs in a “one-stop shop” way now.

Mortgage and pledge registration process has become much faster after refusal of the mortgage judge. This has essentially speeded up the process of mortgage and pledge registration. Now mortgage transaction approved by notary is recorded in the Mortgage register on the same day or no later than the next business day. 85.5% of all mortgages and pledges were registered on the date of data receipt in 2013. In 2011 just 3.5% of all mortgages and pledges were registered on the date of data receipt. Previously mortgage registration process from the moment of applying to the mortgage judge took up to three business days.

The change in the share of mortgages (pledges) registered on the date of data receipt confirms that one of the objectives of mortgage reform – to make the process of registration shorter – was attained.

Before the reform the mortgage transaction had a standardized form, which was set by the Minister of Justice. From now on parties can decide which terms are the most important and should be included into the mortgage (pledge) transaction. Contractual mortgage (pledge) now comes into force after it is signed by the parties of transaction and approved by notary (if there are no other conditions), but not after their registration in the Mortgage Register, like it was before. The purpose of such registration is just to publish legal rights and obligations. The registration of contractual mortgages is not obligatory anymore, but as far as we know, all mortgage transactions are registered in the Mortgage Register.

Amendments to legal acts regulating mortgage stipulation provided with a possibility to pledge not only immovable objects, but also movable property and property rights by mortgage if the property is pledged under a mortgage transaction together with immovable objects. 1,044 mortgage transactions by which movable objects, monetary funds or property rights were pledged together with immovable objects were registered in 2013. That makes 5.0% of mortgage transactions registered during the reporting year. So far parties have had to sign two transactions: Mortgage and pledge. New legislation allows the parties to save funds by signing and registering just one transaction.

As of 1 July 2012 the Civil Code establishes a right of the mortgage creditor to satisfy only the main requirement and interest arising from this requirement from the property pledged by mortgage. Forfeit and losses incurred by the creditor occurring due to failure to perform the obligation secured by mortgage may be secured by maximum mortgage. In 2013 94.0% of contractual mortgages (pledges) registered were of maximum mortgage (pledge) type. Besides, data about amendments to 2,024 transactions by which the type of mortgage (pledge) was changed to maximum mortgage (pledge) were recorded in the register in 2013. Maximum mortgage (pledge) made only 0.2% of all mortgages (pledges) registered in 2011.

A new type of mortgage – company mortgage – emerged after implementation of the mortgage reform which allows pledging a company as a complex of property or a part of the company. 48 company mortgages were registered in 2013.

As of 1 July 2012 the procedure of recovery from pledged property is initiated after the notary public executes the enforcement order. The notarial enforcement order is presented to the bailiffs for execution in accordance with the procedure established in the Code of Civil Procedure. 1,941 entries about the execution of the notarial enforcement order were made in the Mortgage Register in 2013.

After implementation of the mortgage reform, legal mortgage (pledge) is determined not only on the basis of laws or court judgement but also based on the decisions of authorised institutions. 37 forced mortgages and 40 forced pledges established on the grounds of decisions of the State Social Insurance Fund Board under the Ministry of Social Security and Labour or the State Tax Inspectorate under the Ministry of Finance were registered in the Mortgage Register during the reporting year.

Actions of data administration carried out in the Mortgage Register in 2013

| Action of data administration | Number of actions |

| Registration of contractual mortgage | 20,681 |

| Registration of legal mortgage | 3,108 |

| Registration of contractual pledge | 3,210 |

| Registration of legal pledge | 42 |

| Deregistration of mortgage (pledge) | 20,520 |

| Recording of the data amending mortgage (pledge) | 16,066 |

| Entries about the execution of the notarial enforcement order | 1,941 |

| Recording of the data amending entry | 30 |

| Removal of the entry about the execution of the notarial enforcement order | 437 |

| Deletion of the entry about seizure of pledged property recorded by 1 July 2012 | 2,320 |

| Removal of an entry about delivery of a warning to the debtor, made before 1 July 2012 | 12 |

| Removal of an entry about forwarding of a bank account (property right) to the creditor made before 1 July | 11 |

| Recording of the amending data of the pledge contract stipulated before 01/04/1998 | 94 |

| Removal of the pledge contract stipulated before 01/04/1998 | 614 |

| Establishment of a period of time to the data provider for removal of shortages | 2,264 |

| Refusal to register (deregister) an object of the Register,record an entry or the data of object amendment | 198 |

| Total: | 71,548 |

A total of 71,548 actions of data administration were carried out in the Mortgage Register in 2013, i.e. 13.7% more than in 2012.

REGISTER OF WILLS OF THE REPUBLIC OF LITHUANIA

About the Register

The Register of Wills is a non-public state register operating as of 01 July 2001. It is administered by the Ministry of Justice, and the manager is the Central Mortgage Office.

Objects of the register include wills and facts of acceptance of inheritance prepared (deposited for storage) in the territory of the Republic of Lithuania or diplomatic bodies and consular offices of the Republic of Lithuania as well as wills prepared (deposited for storage) in foreign states that adopted, ratified or joined the Convention on the Establishment of Scheme of Registration of Wills adopted in Basel on 16 May 1972 (hereinafter referred to as the Convention).

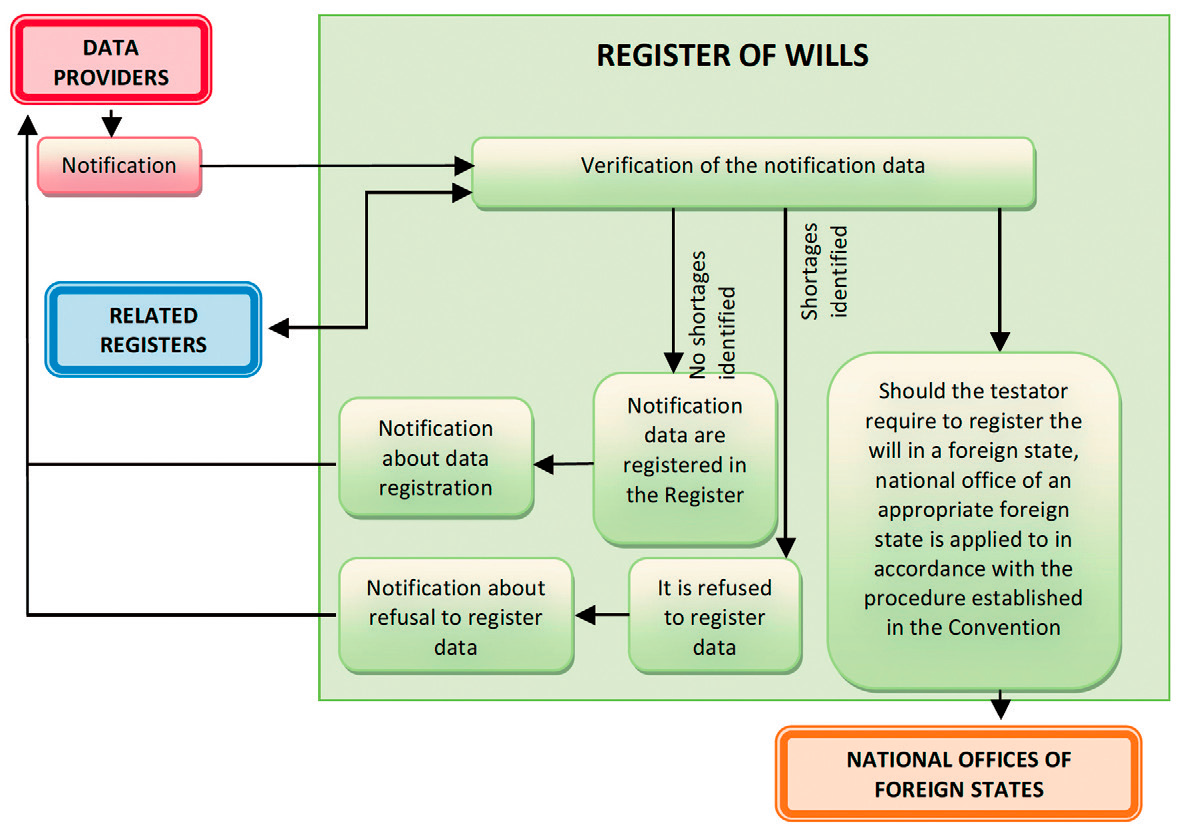

Scheme of registration of objects of the Register of Wills

According to the data of 31 December 2013, a total of 307,745 wills and 429,076 facts of inheritance acceptance were registered in the Register of Wills.

Regulations of the Register of Wills establish that an object of the Register is registered (deregistered), the data is specified within 3 business days from the date of notification receipt.

98.9% of objects of the Register were registered on the date of data receipt.

Provision of Data to the Register

Notaries public, courts, consular officers of the Republic of Lithuania, the Chamber of Notaries of Lithuania and national authorities of foreign states that adopted, ratified or joined the Convention present data to the Register of Wills.

Data providers that stipulated a Contract on Exchange of Data of the Register of Wills submit data to the Register electronically. The Office stipulated 326 contracts with data providers. 980 data providers and persons appointed by them use online application for data provision to the Register of Wills.

Wills

Wills can be official and private.

Official wills are wills prepared in writing in two copies and approved by the notary public or the consular officer of the Republic of Lithuania in an appropriate state. Official wills comprise:

- Wills of persons that are undergoing treatment in hospitals, other stationary health care-prevention institutions, health resorts or the wills of persons living in the homes for old or disabled attested by chief doctors, their deputies for medical matters or doctors on duty of these hospitals, institutions of medical care or sanatoriums, likewise by the directors or chief doctors of such homes for old or disabled people;

- Wills of persons sailing in seagoing vessels or ships of internal waters flying the flag of the Republic of Lithuania, attested by the masters of those ships;

- Wills of persons participating in surveyor, research, sport or any other expeditions attested by the heads of those expeditions;

- Wills of soldiers attested by the commanders of those units, formations or institutions and military schools;

- Wills of inmates of the places of confinement attested by the heads of these institutions;

- Wills attested by the neighbourhood executive managers of the place of residence.

By a general official will of spouses, both spouses appoint each other as their successors and after the death of one spouse another remaining spouse inherits all property of the deceased (including the part of joint property of the spouses) except for mandatory part of the inheritance.

A private will is a will written up in hand by the testator where the name, surname of the testator, the date of will preparation (year, month, day), the place of will preparation are specified and which expresses the testator’s will and is signed by him/her. A testator may transfer a private will for storage to the notary public or consular officer of the Republic of Lithuania in a foreign state.

Four testators in 2013 expressed a wish upon stipulation of wills that their wills were registered in registers of foreign states. Upon request of testators the Office sent 2 notifications about the will stipulated to the Belgium Office administering the Register of Wills and one notification to each of the offices administering Registers of Wills of Ukraine and the Kingdom of Netherlands.

Plans for the year 2014

The Central Mortgage Office constantly develops services of managed registers, seeks to create more and more electronic services. In 2014-2015, we are planning to create a new service – to simplify and improve the process of accepting or refusing the inheritance. This development was partially influenced by the Regulation of The European Parliament and The Council of The European Union No 650/2012, but we want to create more services, than it is required by the Regulation. Newly created services would be available not only for the citizens of Lithuania, who live in Lithuania or other countries and inherit property in Lithuania, but also for the citizens of other countries, who inherit property in Lithuania without leaving their residence country.

We will start creating an electronic service intended for natural and legal persons to present applications to notaries public on acceptance of inheritance or refusal of inheritance. At the moment a person willing to accept inheritance must file an application on acceptance of inheritance with the notary public. After having accepted the application the notary public presents data to the Register of Wills in accordance with the procedure and deadlines established by legal acts and the fact of inheritance acceptance is registered therein. In Lithuania, a person has to contact a particular notary, who manages the territory, where the deceased lived. Tens of thousands persons incur time and travelling costs due to such procedure every year. The planned electronic service would allow a person preparing an application on acceptance or refusal of inheritance by using an online application and present it to the notary public based on the territory serviced by the notary public.

The Central Mortgage Office has an electronic interaction with the Residents’ Register of the Republic of Lithuania and also registers of property (real estate, vehicles, agricultural machinery, and other registers). Individuals can also reach these registers electronically. Each citizen of Lithuania has an access to use e-services of state authorities. Therefore, we have E-government gateway, where individual can access e-services of state authorities. An individual has to identify himself/herself with the e-signature (all citizens, who have an ID card, has the e-signature) or by using the passwords that are used to connect to your e-banking account. The Central Mortgage Office manages the Register of Mortgage and Register of Property Seizure Acts. The data from these two registers are useful for assessing the condition of inherited property and obligations of the deceased. Also, the Central Mortgage Office manages The Registry of Legally Incapable Persons and Persons with Limited Legal Capacity, which help to ensure that an incapable person would not sign the will.

After the notary public approves of the application received electronically, the fact of inheritance acceptance would be registered in the Register of Wills.

In the future we will implement this new service for the citizens of other countries. This could be done within the participation in the CROBECO project.